There are two definitions in the mortgage industry for a buydown. One is most common and simply means the borrower pays points to buy the rate down for the life of the loan (a one-time upfront cost for a longer-term benefit). You can refer to my blog post here where I discuss paying points and if/when it makes sense. That blog was written in 2008, but it still applies.

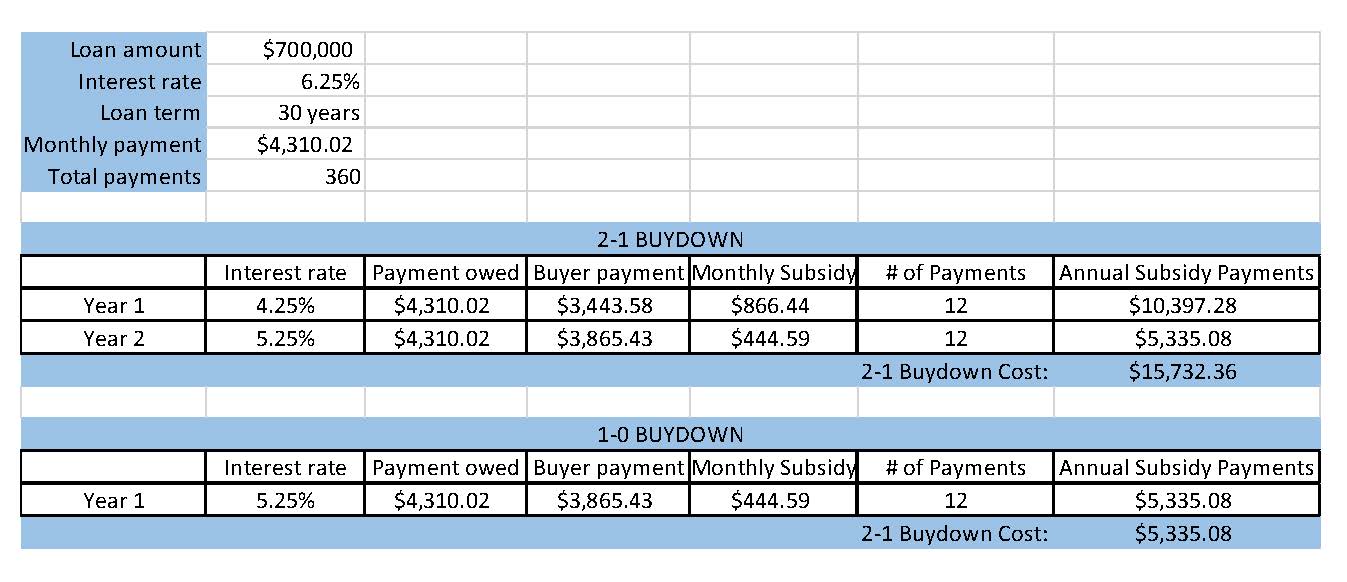

The other type of buydown that is becoming more attractive in this shifting market is a temporary buydown: the interest rate and payment is reduced for the first one to three years of the loan. The buydown options are 3-2-1, 2-1 and 1-0. Very few of my lenders are offering the 3-2-1, so I will illustrate the numbers on the 2-1 and the 1-0.

Here’s an example of how it works and what the numbers are on a $700k loan amount:

If the Note rate is 6.25% and there is a 2-1 buydown, then the buyer’s interest rate in Year 1 of the loan will be 4.25%; in Year 2, it will be 5.25%. Then in Year 3 and beyond, it will be at the note rate of 6.25%. This can be helpful to “ease into” homeownership and the monthly payment responsibilities, especially if you think about the initial costs of any home improvement projects or home furnishing purchases.

The seller is the one responsible for paying the difference in payment between the buydown rate and note rate, and that total amount is held in escrow. You can compare it to the seller providing the buyer with a fixed or percentage concession to buy the rate down in the traditional sense, but this depends on what the buyer and seller agree to, as well as the buyer’s goals for the home and expectation of how long they will own the home. Do keep in mind that the buyer must still qualify at the Note rate of 6.25%.

Reach out to me directly if you have any questions.