FAQs

You will find many of your questions answered in my blog, but these are general Q&As in regards to real estate financing that you may find interesting.

What is the difference between a quoted interest rate and the APR?

A quoted rate is the rate at which you will make your monthly payments. The APR (Annual Percentage Rate) takes into consideration the interest rate plus the cost associated with obtaining your mortgage loan.

What are points and why do some lenders charge them when others don’t?

One point is equal to one percent of the loan amount. If your loan amount is $400,000.00 and you are charged 1 point, that cost is $4000.00. You have the choice to pay points for a lower rate. On the other hand, you can also choose a higher interest rate to get your fees paid for by the lender. What you need to consider is if paying points will be worth the cost. If you will be selling your home or refinancing within a short period of time (generally 1-3 years depending on the amount of points you pay), then it is not a wise idea and you would not see the savings.

What is Private Mortgage Insurance and why do I need to pay it?

Private Mortgage Insurance (PMI) is required by a lender when you put less than 20% down on a home. It can be tax deductible if your Adjusted Gross Income is $100k or less (consult a tax advisor for a personal assessment). In the past, people could not buy a home if they had less than 20% down. Lenders started allowing it many years ago, but would charge a premium, via PMI. The insurance protects the lender against you defaulting on your mortgage; it does not protect you.

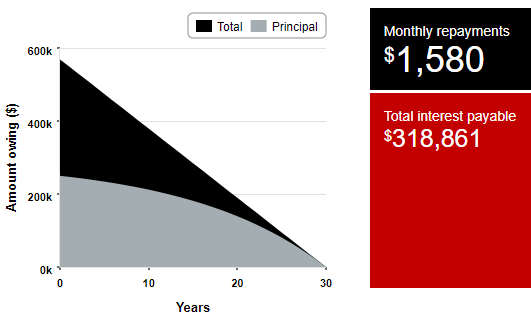

What is the difference between a Fixed Rate Mortgage and an Adjustable Rate Mortgage?

A Fixed Rate Mortgage is fixed for the entire life of the loan (generally 15, 20, 25, or 30 years), whereas an Adjustable Rate Mortgage (ARM) is usually fixed for a specified number of years (usually 3, 5, 7, or 10), then enters into an adjustment period.

What do closing costs include? Why do I have to pay them?

Closing costs cover the processing and administration of every purchase or refinance loan. The amount of the cost varies with each lender, but they should run within a certain range, depending on your loan amount.

What is an impound account?

An impound account (also called an escrow account, or a reserve account) means that your property taxes and homeowners insurance are collected monthly by the lender, along with your mortgage payment. Then, when property taxes are due to the county, and insurance to your insurance company, the lender pays the bills for you. See my blog post here for more details and the advantages/disadvantages of an impound account.

Why should I be pre-approved?

Getting pre-approved is crucial in this market. Firstly, you know your price range and the maximum loan amount you are qualified for. Secondly, you are seen by sellers as a much more serious buyer when you back up your offer with a pre-approval letter. Thirdly, you will save time because you have already gone through much of the loan process by submitting all the necessary documentation, and fourthly, you have been educated about the loan process and about homeownership expectations by your Loan Consultant.

How long will it take before my loan closes?

The average time frame from date of application (or purchase contract) to the date your loan funds is 30 days. This may vary in a sale because the seller may require either a shorter or longer time frame. Also, when we are in a very busy market, it may take longer because lenders are handling too much work load.

What happens if my credit rating is poor? What is a “good” credit score?

Don’t count yourself out if your credit history is less than perfect. There are competitive programs and options available for the many levels of credit worthiness. Credit scores are sometimes referred to on grade levels, so that an “A” paper loan is a borrower with a FICO of 720 and above. Also, the interest rate you qualify for will depend on your credit score, so it’s very important to keep tabs on your credit and use it wisely.

What do I do if I find incorrect information on my credit report?

Dispute it immediately with the three credit bureaus. By law, they only have 30 days to investigate a dispute. Contact each of the bureaus directly:

| Equifax (800) 685-1111 | TransUnion (800) 888-4213 | Experian (888) 397-3742 |

| P.O. Box 740241 | P.O. Box 2000 | P.O. Box 2002 |

| Atlanta, GA 30374-0241 | Chester, PA 19022 | Allen, TX 75013-0036 |

| www.equifax.com | www.transunion.com | www.experian.com |

What payments am I responsible for as a homeowner?

You are responsible for your 1st mortgage payment, your 2nd mortgage payment if you have one, homeowners insurance, and property taxes. Also, if you put down less than 20% and did not qualify for a 2nd mortgage, you may be responsible for paying Private Mortgage Insurance.

My blog answers these and many more questions in great deal, so always feel free to use the “search” option. If you have any other questions, please feel free to email me and I will get back to you as soon as possible.