I offer an equal combination of quality service and competitive interest rates for my clients, from the first time homebuyer to the experienced real estate investor.

If you are a first time homebuyer or are looking for a refresher on buying a home, check out my e-book here: Financing Your First Home

Programs/Products

- Conforming, High Balance, Jumbo conventional loans

- FHA loans

- VA loans (I am a Certified Military Housing Specialist)

- 2nd mortgages: HELOCs and HELOANs (including a 30 Year Fixed rate 2nd!)

- Business Entity loans

- Bank Statement Programs

- “Debt Service Coverage Ratio” loans for investors

- CalHFA-approved

- Homepath Financing

- Preapprovals

- My Watch List

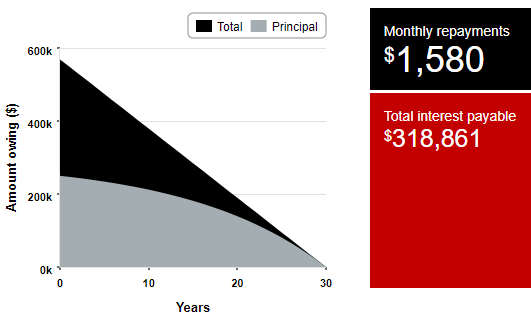

Rates are currently in the 5% to 7% range (updated January 2023), depending on the program. If you are curious to see how they fare for you in your situation and to get on my Watch List, please contact me via email or phone.

Information Needed for a Rate Quote

- Is this for a purchase or refinance? If it’s a refinance, are you taking any cash out or paying off a 2nd mortgage?

- What loan amount are you seeking?

- What is the approximate value of your home (or sales price, if a purchase)?

- Is your home a single family, condo or townhouse?

- Is this your primary residence, vacation home or investment property?

- What loan program are you seeking (30 Year Fixed, 5/1 ARM, FHA loan…)?

- Do you know your credit score? If not, is there any reason to think it’s not good?

Documentation Needed for a Preapproval

- 1 month most recent paystubs

- Most recent 2 years’ W2s

- If self-employed or commissioned, or if any other real estate is owned, most recent 2 years federal tax returns, all schedules & statements

- 2 months most recent asset statements (bank/stock/retirement), all pages

- copy of your drivers license / government ID

Tips and Information for the Loan Process

- The Loan Process

- What NOT to Do After You Apply for a Mortgage

- Tips Regarding Your Refinance

- Who Pays What Per County-CA