Part of Homebuying 101 is what your payment responsibilities are as a homeowner. There are either 3 or 4 items, depending on how much you have to put down.

- Your Mortgage Payment

- Mortgage Insurance (not necessary when you have 20% or more as a down payment)

- Homeowners Insurance (single-family home) OR Homeowners Association (HOA) dues (condo or townhome)

- Property Taxes

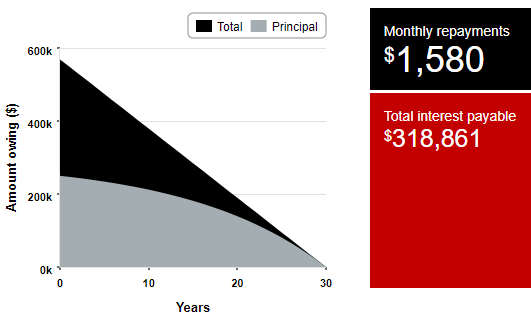

Mortgage Payment: determined by the interest rate that gets locked in and by your loan amount.

Mortgage Insurance: based on the loan amount. The payment is dependent on the Loan-to-Value ratio, in increments of 5%. You will pay a lesser rate the more you put down. You can find rate quotes and parameters on MGIC’s site: http://www.mgic.com/is/html/ratefinder.html#results

Homeowners Insurance or HOA dues: For a single-family home, you will call your insurance agent to get a quote and that will be your premium (probably between $600 to $1100/year). If you’re buying a condo or townhome, the HOA dues are determined by the development you’re buying in. These can vary widely, but on average I see HOA dues somewhere between $250 to $350.

Property Taxes: based on 1.25% of the sale price.